OUTSOURCED ACCOUNTING & ADVISORY SERVICES

About

Many companies face a frustrating dilemma: lack of support and guidance in managing financial, accounting and tax issues. They are often hindered by limited resources. That’s where outsourcing with Gray, Gray & Gray’s Client Accounting & Advisory Services team can make a meaningful difference for your business.

Accounting, financial statements, budgeting – these all take time and attention away from the core focus of managing operations, overseeing employees, nurturing customers and strategic development that leads to profitable growth. When it comes to financial administration and business planning, we’ve got your back. Outsourcing these critical business functions through Gray, Gray & Gray’s Client Accounting & Advisory Services gives you the power to spend more time focusing on what really matters – growing your business.

You gain the benefit of having experienced professionals addressing critical needs, backed by the full resources and support of one of the region’s most respected business advisory and accounting firms. Our team takes on the responsibility for your common business functions so you can work on creating a stronger future for your business.

In addition, our client advisory services are specifically designed to meet the needs of start-up, emerging and growth-oriented businesses. Based on our experience working with hundreds of successful businesses over the past 80 years, we provide you with important insight into your business, allowing you to make more informed decisions for the future of your organization.

Our Experience

You can benefit from Gray, Gray & Gray’s proven experience with all types and sizes of businesses in a variety of industries such as family offices, SaaS companies, architecture and engineering firms, restaurants, private equity firms, commercial real estate and development companies, non-profit organizations, and more.

You don’t have to go it alone. Tap into the Power of More with our outsourced Client Accounting & Advisory Services today to help ensure a more successful tomorrow. The support and guidance provided by our team delivers multiple benefits and added value to your company:

- Gain experienced, professional assistance without hiring additional staff

- Streamline routine business processes

- Improve financial reporting, including real-time data access

- Enhance financial controls and management

- Get proven “best practices” advice and guidance specific to your industry

- Save time and money

Our Services

Our Client Accounting & Advisory Services team provides a variety of outsourced solutions to help you take your business to the next level. Services include:

Professional Accounting Support

- Accounting Systems Design & Implementation

- Cloud-based Accounting & Financial Data Access

- ASC 606 Revenue Recognition Implementation

- Merger & Acquisition Pre-Diligence Support

Business Process Outsourcing

- Transactional Processing

- Accounts Payable & Bill Payment

- Accounts Receivable & Invoicing

- Expense Report Payment & Processing

- Cash Management

Financial Reporting

- General Ledger/Trial Balance

- Cash Reconciliation

- Financial Statements

- Monthly Close Reporting

Virtual - Fractional CFO/Controller

- Financial Strategy

- Risk Management

- Financial Modeling

- Comparative Reporting

- Budgeting & Forecasting

- Market Analysis

- Special Projects

Financial Dashboard

- Instant Access to Financial Data

- Performance Analysis

- Real-Time Metrics

Related Pages

The Advisor Newsletter

Sign up for our newsletter and receive tax tips, event invitations, important reminders and more. Join Now!

Resources

News & Events

Our Approach

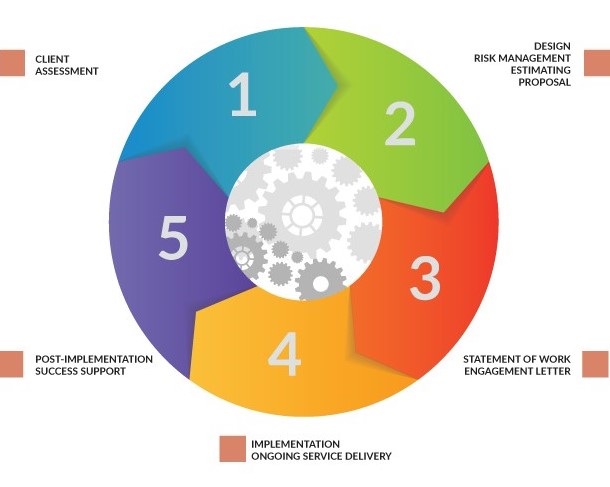

Client Assessment

The best outcomes result from a strong start. For that reason, we conduct a thorough and detailed analysis of your current accounting, bookkeeping and financial reporting processes. Gaining a full understanding of your operating environment gives us the opportunity to recommend improvements and changes that will create a more efficient and effective system.

We use a business process modeling tool to identify operational inefficiencies and areas for improvement, including transaction workflow, procedures and best practices that your organization has adopted.

The Client Assessment phase usually requires 1-2 days.

Design, Risk Management, Estimate

Using the information gathered during our Client Assessment, we develop a plan that combines business process improvements and technology to create more efficient financial and accounting processes for your organization. One of our goals is also to make the plan scalable so that it can grow to meet your expanding needs.

Finally, we will meet with you to present our plan and estimated cost for implementation.

Engagement

You may choose to outsource a portion or all of your finance and accounting function to our team. Each activity is assigned a manager responsible for implementation and ongoing service delivery, as well as training and regular communications with you and your staff. If implementation calls for an upgrade or change in your financial management software, this is the point at which we will begin the changeover.

Implementation

We work closely with your internal financial staff to transition the specific activities you have decided to outsource. For organizations without internal accounting resources, we fully manage the conversion process.

The transition process includes secure data import and testing prior to deployment. All procedures are verified and assessed before being transitioned. The result is a virtual financial department that runs more efficiently and securely.

Outsourcing your accounting and financial reporting is a smart business move for many, offering flexibility in gaining greater efficiency at a reduced cost. Our outsourcing program streamlines procedures and improves reporting of mission critical data and information, allowing you to make better, faster decisions.

Post-Implementation Success Support

Your success is our goal. As a client of Gray, Gray & Gray, you will have access to our team throughout your engagement with us. We are here to help guide and support you in your daily business operations.

How We Help Clients

Below are examples of some of the recent ways we have assisted clients with their Outsourced Accounting needs.

Business, Tax & Daily Financial Planning:

Branding Company

Profitability Planning:

International Start-Up SaaS Company

“I have truly enjoyed the partnership with Gray, Gray & Gray – especially during this very challenging year. The firm helped us navigate a broad range of issues from business planning to tax planning to day-to-day financial management with care and professionalism. They work together as a team – everyone is on the same page so when I call with a question it’s easy to get a quick and thoughtful answer which allows me to make the smart and informed decisions required to run the business.” – Jen Harrington, President, HATCH The Agency

An international start-up SaaS company doing business in Europe has plans to set up operations in the U.S. The company’s plans also include moving individuals to the U.S. in order to work at the new U.S. operations.

The SaaS company sought an accounting firm that could provide personal and business tax services for its international entities. The company did not want to be bogged down with accounting work and was looking for an accounting service provider specializing in international business that could partner with them and lend the support necessary to help them successfully navigate setting up and running their U.S. operations. They chose to outsource their accounting needs to Gray, Gray & Gray.

In the beginning, the company’s accounting needs were minimal and handled via QuickBooks. Now that the company is up and running, has its sales team in place, and is generating sales, Gray, Gray & Gray has taken their accounting to the next level and shares advice as well as best practices in order to help meet their growing business demands.

Gray, Gray & Gray moved the SaaS company’s entire accounting and bill payment systems to the cloud in order to provide more accurate and current financial information during the company’s critical growth phase. By working in the cloud, the company enjoys collaboration in real time, giving them confidence in the financial state of their business. Through the cloud, they can have conversations about the company’s financials in the U.S. and overseas. They also have access to a live dashboard with key performance indicators specific to the company management’s needs. This reliable information not only helps to guide their daily operations and business decisions, but it helps with the year-end process as well. Documents are readily available in real time for both the company and Gray, Gray & Gray to access in order to complete the year-end tax work.