SAGE INTACCT ACCOUNTING SOFTWARE - TWO OPTIONS TO MEET YOUR NEEDS

BUILD YOUR BUSINESS ON A STABLE FINANCIAL FOUNDATION

The core of business growth is solid financial management. Timely access to accurate financial data allows you to overcome challenges and take advantage of opportunities by making more informed and focused decisions.

The advisory and accounting services provided by Gray, Gray & Gray offer you the tools and support necessary to build efficiencies through access to mission critical financial data. All backed by more than 78 years of experience with organizations of all types and sizes.

To accomplish this for our clients we partner with Sage Intacct to provide proven, potent software solutions to augment your current accounting function and power your business success.

Two Options to Meet Your Needs

Every business has its own specific needs, depending on the challenges presented, its stage of growth, and countless other factors. That’s why we offer flexible ways to gain the power of the leading enterprise software platform:

1: Leverage Sage Intacct accounting software for your team

Has your organization outgrown its accounting software? Do you have a highly competent accounting department but lack the software needed for real-time insight into your business financials and operations? This is the solution for you! Gray, Gray & Gray offers Sage Intacct accounting software on a subscription basis. By leading your software implementation our team makes the transition from your legacy accounting software system to Sage Intacct an efficient and seamless experience. Learn more here.

2: Outsource your accounting function to us

Looking to grow your business rapidly with the help of skilled financial professionals who can manage the accounting function for you? We have you covered. Gain the benefit of having experienced professionals addressing your critical needs, powered by Sage Intacct accounting software and backed by the full resources and support of one of the region’s most respected business advisory and accounting firms. Our team takes on the responsibility for your common business functions so you can concentrate on creating a stronger future for your business. Learn more here.

Which Solution is Right for You?

The first step in determining which solution may be right for your business is to discuss your organization’s goals and identify the specific needs to be addressed. Based on this information we can guide you through the differences and benefits of each solution, leading to the optimal solution for your needs.

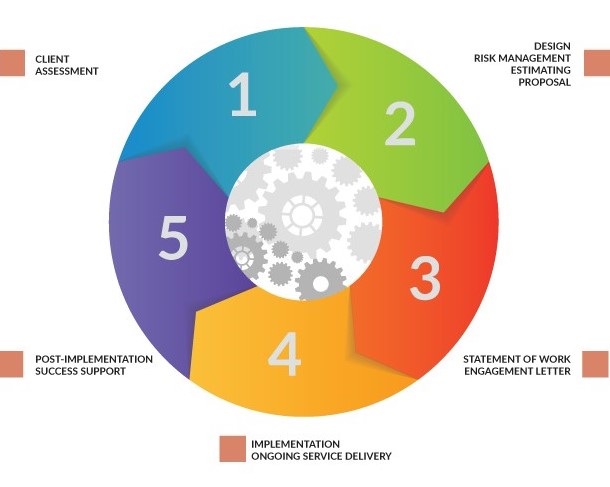

Our Approach

Client Assessment

The best outcomes result from a strong start. For that reason, we conduct a thorough and detailed analysis of your current accounting, bookkeeping and financial reporting processes. Gaining a full understanding of your operating environment gives us the opportunity to recommend improvements and changes that will create a more efficient and effective system.

We use a business process modeling tool to identify operational inefficiencies and areas for improvement, including transaction workflow, procedures and best practices that your organization has adopted.

The Client Assessment phase usually requires 1-2 days.

Design, Risk Management, Estimate

Using the information gathered during our Client Assessment, we develop a plan that combines business process improvements and technology to create more efficient financial and accounting processes for your organization. One of our goals is also to make the plan scalable so that it can grow to meet your expanding needs.

Finally, we will meet with you to present our plan and estimated cost for implementation.

Engagement

You may choose to outsource a portion or all of your finance and accounting function to our team. Each activity is assigned a manager responsible for implementation and ongoing service delivery, as well as training and regular communications with you and your staff. If implementation calls for an upgrade or change in your financial management software, this is the point at which we will begin the changeover.

Implementation

We work closely with your internal financial staff to transition the specific activities you have decided to outsource. For organizations without internal accounting resources, we fully manage the conversion process.

The transition process includes secure data import and testing prior to deployment. All procedures are verified and assessed before being transitioned. The result is a virtual financial department that runs more efficiently and securely.

Outsourcing your accounting and financial reporting is a smart business move for many, offering flexibility in gaining greater efficiency at a reduced cost. Our outsourcing program streamlines procedures and improves reporting of mission critical data and information, allowing you to make better, faster decisions.

Post-Implementation Success Support

Your success is our goal. As a client of Gray, Gray & Gray, you will have access to our team throughout your engagement with us. We are here to help guide and support you in your daily business operations.

Explore Sage Intacct Today

For a hands-on demonstration of the power and performance of Sage Intacct accounting software, and insights on

how it can help your business move confidently to the next level, contact us.